U

.S. commercial gaming revenue for the second quarter of 2020 totaled $2.30 billion, a steep 78.8 percent year-over-year contraction, according to the American Gaming Association’s (AGA) new Commercial Gaming Revenue Tracker.

Due to the impact of the COVID-19 pandemic, the U.S. gaming industry saw revenue decline in nearly every reported vertical compared to Q2 2019.

“COVID-19 has undoubtedly posed the most difficult economic challenge the gaming industry has ever faced,” said AGA President and CEO Bill Miller. “Yet, gaming’s record popularity prior to COVID-19, as well our resilience in the midst of such adversity, is evidence of the industry’s foundation for continued success as we emerge from the pandemic.”

Contrary to recent revenue declines, commercial casinos demonstrated strong consumer demand in 2020 when open for business. Before all 989 U.S. brick-and-mortar casinos closed their doors in March, combined commercial gaming revenue for January and February was up 10.4 percent year-over-year. Following the return of casino gaming in Q2, several states have reported a year-over-year uptick in average daily GGR per open casino despite operating with limited capacity, game availability, and amenities. This includes South Dakota (+42.5%), Ohio (+19.3%), and Indiana (+7.4%).

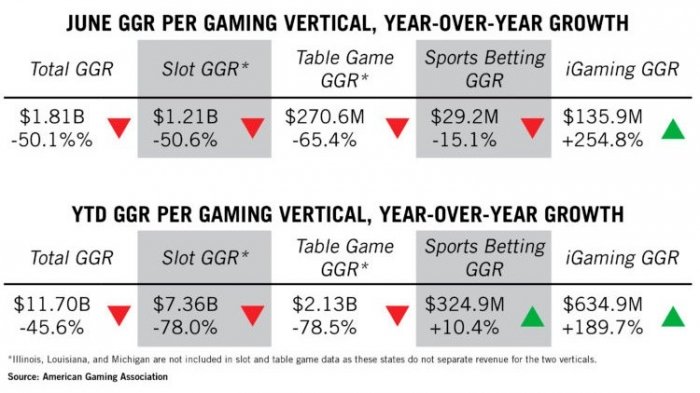

While April and May both experienced year-over-year GGR declines north of 90 percent, June saw nearly 300 commercial casinos reopen throughout the month and, as a result, revenue was nearly four times greater than the previous two months combined. More than 85 percent of U.S. casinos are now open, including nearly 9 in 10 commercial casinos, all of which have implemented stringent, regulator-approved health and safety plans.

“The gaming industry has been a leader in implementing rigorous, innovative protocols that have allowed the vast majority of our properties to reopen and stay open,” continued Miller. “With business returning to casino floors and sportsbooks seeing increased action, the gaming industry is steadily charting a responsible path to recovery that prioritizes health and safety, supports the communities where we operate, and offers first-class entertainment.”

Sports betting experienced a sharp decline in GGR in the second quarter due to the shutdown of sports activity, but is still up slightly (4.1%) in the first half of 2020 as a result of a record start to the year and increased legal options.

iGaming, the only gaming vertical to experience year-over-year growth in Q2 2020, marked the first full quarter generating more revenue than sports betting in the post-PASPA era. Online casino gaming is only legal in six states: Delaware, Pennsylvania, Nevada (poker only), New Jersey, and Michigan (not live).

AGA’s reporting on the financial performance of the U.S. commercial casino industry will continue on a quarterly basis as the association tracks the industry’s economic recovery.

The AGA’s State of the States 2020 report found that the U.S commercial gaming industry generated record revenue in 2019. The companion AGA State of Play map houses economic impact and regulatory data for each of the 44 gaming states.

To date, 851 of 990 U.S. casinos properties across 40 states have partially reopened. This includes 417 commercial casinos (89.7% of total) and 434 tribal properties (82.8% of total). The AGA’s COVID-19 casino tracker lists the reopening status of every U.S. casino.

Read an overview of the various practices that gaming companies have implemented based on a review of AGA member health and safety plans.

About the Report

AGA’s Commercial Gaming Revenue Tracker provides state-by-state and cumulative insight into the U.S. commercial gaming industry’s financial performance based on state revenue reports. The first issue highlights second-quarter results, ending June 30 (Q2 2020), and year-to-date comparisons.