According to industry insiders, Queensland’s casino regulator and its actions should be scrutinized by the state’s inquiry into the Star Entertainment Group. Executives for the Australian casino giant have been giving evidence to a commission of inquiry into the operation of its existing casino licenses in Brisbane and the Gold Coast, which now prepares to release its final report.

Star admitted it should not have opened its doors to “highly suspicious cashed-up gamblers” banned from casinos in other states, or allowed tens of millions of dollars in disguise as expenses to be gambled using a Chinese bank card.

The inquiry also heard evidence that Star’s anti-money laundering processes were highly deficient. Last week, allegations of links between Star’s partner in its new Brisbane development, Chow Tai Fook, and organized crime were revealed, and they are currently under investigation by the Queensland government, reports ABC Australia.

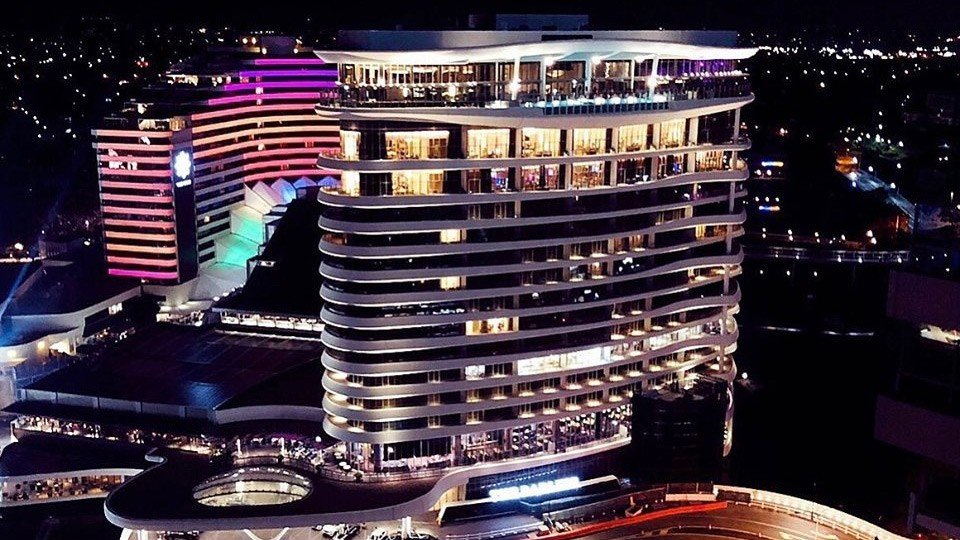

The Star's Gold Coast Casino in Queensland.

However, the body responsible for overseeing casinos in Queensland, the Office of Gaming and Liquor Regulation, has not been a part of these hearings, and its staff has not been required to give evidence about the actions they took.

Tim Nicholls, Queensland’s shadow attorney-general, stated the commissioner does not have the power to call for evidence. “The government must act to broaden the terms of the scope of the inquiry that is currently underway”, he pointed out, as reported by the cited source.

Casino regulation consultant David Green questioned why the inquiry only heard a few days of evidence, saying that the duration of the inquiry suggests it was never intended to be a “far-reaching deep-dive”. “You really need to get the whole regulatory environment examined to say ‘well, why have these risks materialized in an environment which claims to have controlled them?” he noted.

Ben Lee, a casino consultant in Macau who has worked in the Australian industry, ahedered to this notion and said: “I think it’s a control exercise, to basically go through the motions of conducting an inquiry without really conducting an inquiry.”

He also believes not putting the regulator’s actions under detailed scrutiny could mean potential flaws in the system go unaddressed. “We don’t know how personal, or to use another word, unprofessional, the relationship has become between the regulator and Star,” he noted, according to ABC Australia.

The calls add further pressure on the Palaszczuk government to broaden the inquiry after the Office of Liquor and Gaming Regulation confirmed it was investigating fresh allegations made about the conduct of casinos in Townsville and Carns. The allegations, which involve a different casino operator, were first reported by the Channel 9 program 60 Minutes.

Queensland Attorney-General Shannon Fentiman.

However, Queensland Attorney-General Shannon Fentiman has rejected the calls to broaden the inquiry. “The conduct of Star in Queensland and New South Wales is of great concern and raises questions around ongoing suitability to hold licences for and operate casinos,” she said, as reported by 7.30, defending the current scope. “That’s why suitability investigations are being undertaken and the independent external review is being conducted, including to provide advice regarding the suitability investigation.”

Star Entertainment must now wait a month for the outcome of the damning public hearings into its Queensland operations. As part of the inquiry, the company was also asked about gifts it provided to a suspicious high roller, including tickets to a concert by the Village People to encourage him to try his luck on the Gold Coast. The gambler, who had been banned from NSW casinos, was also given private jet flights, a Rolex, and even a special birthday cake.

Star Entertainment's interim CEO Geoff Hogg.

Star Entertainment’s interim CEO Geoff Hogg told the inquiry that his company had relied on what it now concedes is incorrect legal advice that it could not immediately exclude patrons banned from interstate casinos. “I think in hindsight we clearly should have been asked more questions from that point,” he said.

Jonathan Horton QC said that of the 768 people banned from NSW casinos, 36 were later allowed to play the tables in Queensland. “On that topic, we say the errors placed in serious jeopardy the integrity of Queensland casino operations,” he noted.

Star’s general manager of anti-money launder/counter-terrorism financing compliance, Howard Steiner, acknowledged failures of the compliance strategy and a “culture of the past that does not exist today.” “I think we’ve addressed that cultural change within the Star and our culture like that are a vestige of the past,” he said.

While Star conceded its anti-money laundering processes were “seriously deficient”, the company argued it had made significant strides to address those deficiencies and they were now effective.

Fentiman said the present inquiry could still make recommendations about the role of the regulator in its final report due at the end of the next month. “The review will consider and make recommendations regarding enhancements to the regulation of casinos in Queensland,” she said. “This is in addition to legislative changes that are already before parliament.”