I

nspired generated Total Revenue of $71.7 million and Adjusted EBITDA of $34.9 million in the fourth quarter 2020 on a reported basis5. These results include a payment from a UK LBO customer related to our contractual revenue share of their value-added tax rebate, which positively impacted Revenue by $32.5 million and Adjusted EBITDA by $31.7 million (in conjunction with third party fees).

“October was a stellar month and indicated how quickly we could recover before our land-based businesses went back into lockdown in November and December,” said Lorne Weil, Executive Chairman of Inspired. “Our October monthly Revenue of $21.2 million6 and Adjusted EBITDA of $6.8 million6, or 32% of total revenue, was nearly 20% above October 2019 and the highest monthly levels we experienced in 2020, excluding the VAT-related income. This follows the general pattern we saw of sequential monthly growth throughout the third quarter 2020 following the second quarter lockdown. Importantly, year to year growth in October occurred despite the fact that October performance was impacted by pub curfews in early October and the introduction of tiered closures in the second half of the month.”

Revenue and Adjusted EBITDA were negatively impacted in November and December by the COVID-19 Closures. In November, most of our land-based customers’ venues were closed. In December the UK had a tiered lockdown system whereby many of our land-based customers’ venues were open but restricted, limiting revenue while incurring near-full service costs. This tiered system is not expected to return in England.

The Company’s aggregate business across its Online Virtuals and Interactive channels showed strength in the quarter with revenues increasing sequentially from $3.0 million in October to $3.3 million in November to $4.2 million in December. This reflects year-over-year growth of 89%, 95% and 99%, respectively, over $1.6 million, $1.7 million and $2.1 million in the same months in 2019, demonstrating the growing presence and popularity of the Company’s online offerings.

Weil continued, “While the UK is expected to remain on lockdown through the first quarter 2021, based on the UK Prime Minister’s public statement on February 22nd, and assuming achievement of key goalposts, the UK will ease lockdown restrictions in stages with LBOs reopening in April, pubs and holiday parks reopening in May and an end of the lockdown by June 21st. By the end of the second quarter 2021, assuming the UK ends its lockdown, we would expect our UK business to be on a run rate similar to where we were in the third quarter 2020 when we generated $17.1 million6 in Adjusted EBITDA, excluding VAT-related income, at current exchange rates.”

“Furthermore, by the third quarter 2021, we expect to have the added benefit of our online business having grown substantially year over year with continuing expectations for growth from that higher starting point due to a strong business development pipeline, including new commercial agreements in existing territories, jurisdictional expansion in North America, Europe and South America and continued strong product development across both Interactive and Online Virtual Sports. We also expect to have our holiday park business back to pre-pandemic levels, which was not the case in the third quarter 2020 given local restrictions. We’re confident that, as we did last time, we will recover quickly once lockdowns are lifted to emerge from this pandemic even stronger than before with a lower cost structure, improved liquidity, a larger customer base and increased growth opportunities,” concluded Weil.

Overview of Fourth Quarter Results Versus Prior Year Fourth Quarter on a Reported Basis

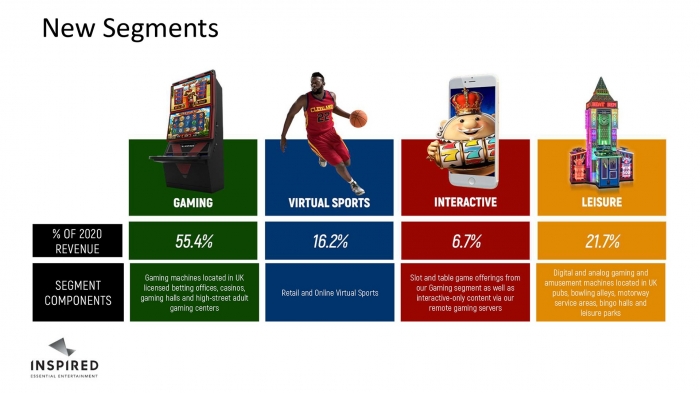

Gaming Revenue was $50.5 million, an increase of 52.3% from $33.2 million in the fourth quarter 2019, in part due to $32.5 million in VAT-related revenue. Gaming Service Revenue was $44.3 million, an increase of 102.1% from $21.9 million in the fourth quarter 2019. Gaming service revenue was favorably impacted by the VAT-related revenue, which was offset by COVID-19 Closures in the UK ($6.8 million), Greece ($2.3 million) and Italy ($1.7 million). Gaming Product Revenue declined to $6.2 million from $11.3 million in the fourth quarter 2019. Revenue during the quarter consisted of the sale of Valor™ terminals ($1.4 million), Sabre Hydra™ electronic table games and machine sales in Italy ($0.9 million).

Virtual Sports Revenue, which no longer includes Interactive but does include Online Virtual Sports, increased 1.8% to $8.7 million from $8.5 million in the fourth quarter 2019. Due to the COVID-19 Closures and resulting growing migration to gaming online, Online Virtual Sports increased $3.0 million year-over-year while retail revenue declined $2.8 million.

Interactive Revenue increased 99.5% to $4.2 million from $2.1 million in the fourth quarter 2019. The revenue growth came primarily from our existing customer base in Europe, reflecting the growing migration of end users to online platforms, an increase in the volume and popularity of the Company’s new proprietary content, significantly improved game quality and strong account management. Additionally, Inspired launched with over 42 new online customers in 2020 throughout the UK, New Jersey, Canada, Greece, Mexico, Germany, Belgium, Italy and Sweden and further expanded its base of interactive aggregators.

Leisure Service Revenue was $7.7 million in the fourth quarter 2020 compared to $21.8 million in the prior year period. Revenue from pubs, leisure parks and MSAs was lower than the prior year as a result of the COVID-19 Closures. Revenue generated from pub customers was $2.8 million, compared to $10.5 million in the prior year period; leisure park customers was $2.6 million, compared to $5.9 million in the prior year period; and MSA customers was $1.8 million, compared to $4.2 million in the prior year period. Leisure Product Revenue was $0.6 million in the fourth quarter 2020 versus $0.8 million in the prior year period.

Total Company SG&A expenses decreased by $7.2 million, or 23.0%, on a reported basis, to $24.1 million. This decrease was driven by staff cost savings of $3.7 million due to the furlough scheme and synergies achieved, a cost savings on facility costs of $1.0 million, $1.0 million reduction in professional fees and $0.7 million of lower travel and expense costs due to the COVID-19 pandemic. Italian tax-related costs decreased by $0.4 million (excluded from Adjusted EBITDA) and costs of group restructure decreased by $0.2 million (excluded from Adjusted EBITDA).

Total Company Net Cash Provided by Operating Activities Less Capital Expenditures during the quarter increased to an inflow of $13.4 million from an outflow of $2.6 million in the prior year period representing a $16.0 million increase in cash generation. This was helped by a $31.7 million VAT-related income payment and partly offset by a $12.6 million bi-annual interest payment.

SEE FULL REPORT HERE